Business Insurance in and around Silver Spring

Silver Spring! Look no further for small business insurance.

Cover all the bases for your small business

Business Insurance At A Great Price!

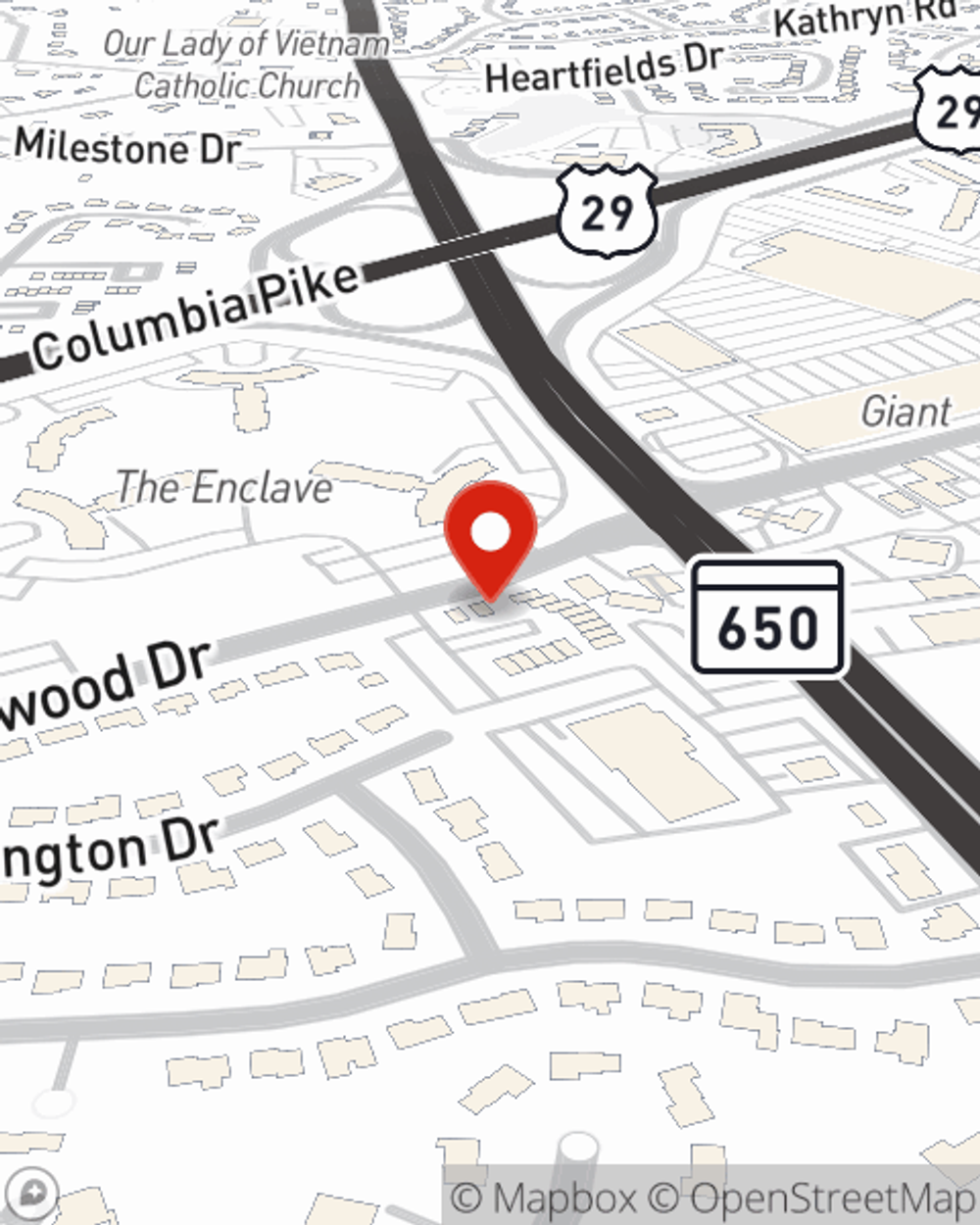

You may be feeling like there is so much to do with running your small business and that you have to handle it all by yourself. State Farm agent Ray Mensah, a fellow business owner, understands the responsibility on your shoulders and is here to help you personalize a policy that's right for your needs.

Silver Spring! Look no further for small business insurance.

Cover all the bases for your small business

Customizable Coverage For Your Business

For your small business, whether it's a window treatment store, a boutique, a home cleaning service, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, buildings you own, and computers.

When you get a policy through one of the leading providers of small business insurance, your small business will thank you. Visit State Farm agent Ray Mensah's team today to get started.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Ray Mensah

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.